It happened to me again this past week. I had a life insurance policy holder e-mail me with this question:

When I die do I get my death benefit and my cash value or just my death benefit?

Let’s start by saying she won’t get anything – she will be dead!

I asked her and her husband to either join me for a webinar or come to my office because my response deserved more than a mere e-mail answer. When they arrived at my office I asked her if she had received information from someone which triggered her question. I asked because there is a fundamental misunderstanding behind this question I have heard a million times. What is most surprising to me is that most people who hear the false statement simply believe it and sometimes even repeat it without taking the time to study it themselves. In this case they are simply repeating a false belief. What is the misunderstanding?

When you die with permanent life insurance, the life insurance company keeps your cash value.

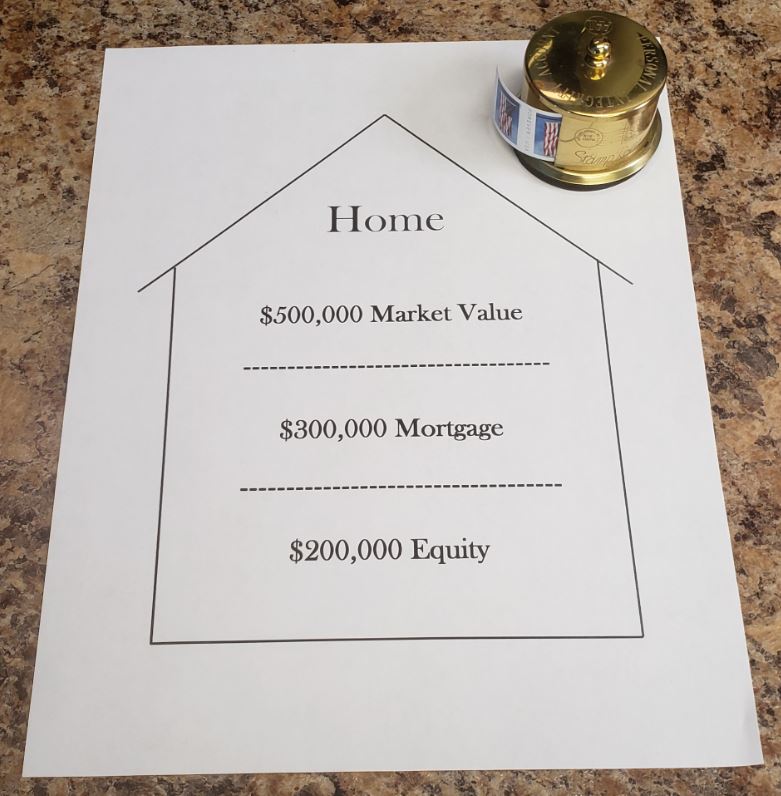

I’m blogging about the subject this week as I thought of a new concept to elaborate on the subject. To do so, I am going to compare the life insurance to a home with a mortgage. For our example we assume the home’s market value is $500,000 and the current mortgage balance is $300,000. A fundamental question we must ask is: What amount of money is the home owner paying interest on to a mortgage company? The answer is $300,000. This is the dollar amount of someone else’s money (an institution in this case) the home owner is using and is therefore paying a cost for that use.

If the homeowner were to sell he/she/they would receive $200,000 (Disregarding fees and real estate agent commissions) . This represents their equity in the home. Because we are comparing the home to a life insurance contract it is important to point out what value would be distributed to heirs in the event of the homeowner(s) death. The answer is the same $200,000 the homeowners would receive if they sold.

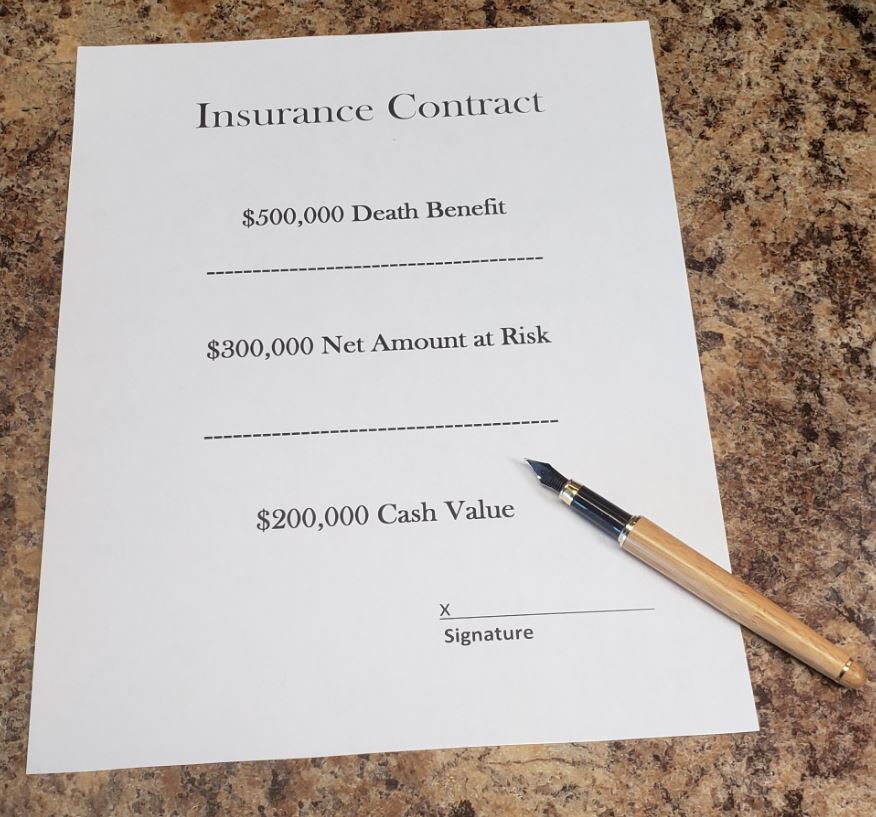

With the permanent life insurance contract we evaluate the death benefit is $500,000 and the policy owner has accumulated $200,000 of cash value. This cash value is a “terminal reserve” of money set aside by the insurance company. For the illustration here we assume the permanent life insurance is Whole Life.

It is important to begin by understanding what this reserve is for. This reserve is being set aside on an annual basis with guaranteed assumptions that the dollar amount of the cash value/reserve equals the amount of the death benefit when the life insurance contract matures. For our discussion here if we assume the contract matures at age 100 the policy owner would receive a guaranteed check in the amount of $500,000 at age 100. Now we evaluate what happens before age 100.

In this case if the policy owner decided to sell his/her policy back to the insurance company, they would pay $200,000 just like the homeowner would receive their equity in the home.

If the insured died, the beneficiary(s) would receive the cash value plus the net amount at risk. What on earth is the net amount at risk? This is the dollar amount the policy owner is paying insurance costs on, just like the homeowner is only paying costs for the amount of the mortgage, not for the entire market value of the home.

The policy owner is not paying insurance costs for the entire death benefit.

They are only paying insurance costs on the “net amount at risk”.

This is the magic behind permanent life insurance. It is the key which allows the premium to stay level for a lifetime. When the cash value increases, the net amount at risk decreases therefore offsetting the higher cost to provide a death benefit as the insured gets older.

Oh how much do the beneficiaries receive when the insured dies? $500,000 not merely the cash value or equity like the mere $200,000 the heirs would receive in the event of the homeowners death. This too is the magic of permanent life insurance. The insurance company takes the cash value/equity, adds to it the “net amount at risk”, and pays out the death benefit.

The life insurance contract is a valuable asset which builds equity and can be an important part of a person’s net worth. It contains some very special and unique characteristics which take time to understand. For those who have a bias against the financial tool, it is possible they chose to repeat the fallacy we have been discussing here simply to downplay the value of the insurance.

An understanding of this fundamental reality of permanent life insurance is basic. So the next time you hear someone say that the life insurance company keeps your cash value when you die, you will know the truth.

To learn more about how permanent life insurance can be incorporated into a sound financial plan, to help eliminate lost opportunity costs, and provide options for producing more retirement income see Incisic.com

Financial Well-Being through Sound Instruction