Today we cover a simple example of why Rate of Return (ROR) shouldn’t be our primary focus. Instead our primary focus should be on financial strategy. To make the point we follow a simple story.

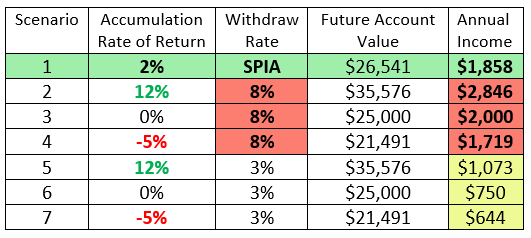

Use the following chart as a reference to the scenarios as the story unfolds

Pam is the owner of a small privately held business. The majority of her net-worth is in the business. She is fortunate that businesses in her industry are pretty easy to sell, so she is already positioning herself to create various streams of income in retirement.

She wants to start making a small annual contribution of $5,000 to an IRA. Her financial advisor has suggested she simply invest in bonds for five years earning an assumed 2% rate of return and then have them available to “annuitize” at retirement to produce a guaranteed income for life. By investing in high grade quality bonds, incorporated in the manner suggested, there is little risk and the income from the insurance company will be guaranteed for life. She would annuitize using a Single Premium Immediate Annuity (SPIA). She has no family so this form of annuitization will likely produce the highest level of income. This becomes scenario #1 above.

Her brother who is a ‘stock picker’ says; “why would you do that? I get can you a better rate of return”. She is so enamored, as we all are with rate of return, she can’t understand why this approach isn’t better. Let’s take a look at some potential realistic outcomes and some which are unrealistic.

If you study Dave Ramsey’s advice you will see at the core it is predicated on earning a 12% rate of return every year of your life. If we follow this logic after 5 years of investing in her IRA Pam is suppose to have $35,576 dollars (Scenario 2). If we also follow Dave’s advice she can utilize an 8% withdrawal rate from the initial account value to produce retirement income. His belief in this being a realistic approach can be well documented. It is based on the premise that “on average” you earn 12% therefore you can safely withdraw 8% for income and the remaining earnings will offset inflation. Using this theory Pam is suppose to have $2,846 of retirement income (Scenario 2).

For a minute let’s assume her investments did not fair so well and she earned either a 0% or -5% return over the five years. In this case, again using an 8% withdrawal rate she is supposed to have have either $2,000 (Scenario 3) or $1,719 (Scenario 4) of retirement income.

There is plenty of research available which proves that an 8% withdrawal rate is not sustainable. In fact in today’s low interest rate environment a 3% withdraw rate is more readily viewed as acceptable. If we take the same rate of return assumptions just used this would provide Pam with a high of $1,073 (Scenario 5) to a low of $644 (Scenario 7) of retirement income.

All of these realistic retirement income amounts are lower than the $1,858 of income (Scenario 1) the combined strategy would provide. So much for seeking a higher ROR over a coordinated strategy. The only ROR strategies which produce more income are based on assumptions that are proven to be unrealistic. There is no guarantee with the strategy built entirely on ROR and the SPIA strategy produces guaranteed income. Based on what we have learned, in fact Pam’s brother cannot produce more income.

Rates of return will make virtually no difference for us financially unless we are able to leverage them in a long compound interest curve. A five year time frame does not even come close to entering the third phase of the compound interest curve therefore rate of return should not be the primary focus.

Financial Well-Being through Sound Instruction